One of the most interesting policy questions in 2025 is the tariff. Are tariffs a good idea that will bring manufacturing jobs back to the U.S. and strengthen the economy? Or are they a foolish idea that will it bring inflation and recession to the economy? These questions are influenced by our perspectives of President Trump. Those who support the President are more likely to give tariffs a chance, whereas those who oppose the President are more likely to take a dim view of the tariffs. Confirmation bias (the tendency to interpret new evidence as confirming one’s existing beliefs) undermines our efforts to be objective. History, on the other hand, provides an opportunity for students to study tariffs with less bias, allowing for a more objective analysis.

The following lesson puts students in the position of deciding whether to raise the tariff in 1930. This is the Smoot-Hawley Tariff of 1930, made famous in the film Ferris Bueller’s Day Off. (“Congress passed the Smoot-Hawley Tariff which raised or lowered…Anyone? Anyone?”) Students have to wrestle with arguments for and against the tariff before they know what happened.

Procedure

The below lesson outlines a Decision-Making in U.S. History sample lesson that can teach students how to critically think and make decisions about key events in United States history. To start, distribute Handout 1 and review the problem and any specialized vocabulary. Have students individually write down their decisions regarding the tariff. Then pair students up to discuss their choices. Bring the class together to vote on whether they will support raising the tariff. Record the votes and ask for arguments for and against the tariff.

Distribute Handout 2 and have students fill in whether the evidence support (S) or weakens (W) the argument for high tariffs. Again, you could pair students up to discuss their answers followed by a general class discussion. Overall, does this evidence support or weaken the argument for a high tariff?

Distribute Handout 3 and review the outcomes of the Smoot-Hawley Tariff. What did students learn about tariffs from this lesson? What did they learn about decision making?

Here are excerpts of the lesson. You can find the full 9-page lesson on my website. (Click on U.S. History, then the 1930s-1940s unit.)

Sample Lesson

Handout 1: Problem (Excerpt)

It is 1930 and you have to make a decision on whether to raise tariff (tax) rates on imports coming into the United States. The tax is paid by the importing company, in this case the American importer, to the government. The importing company most likely would add the tax it paid to the price of the product, but it could raise the price by only a portion of the tax, reducing its profit.

The economic setting in 1930 is poor. The stock market crashed at the end of 1929. Many businesses are closing and unemployment is rising rapidly.

Part 1: Arguments

Directions: Read the arguments below for and against the tariff and then write your decision about whether to raise the tariff.

Arguments for a high tariff:

Argument A

The tariff is needed to protect American workers from competition from lower-paid foreign labor. We don’t want to lose jobs to workers in other countries who are paid lower wages because the country is poorer.

Argument B

A high tariff protects American businesses from competition. As a result, those businesses expand and invest in more machinery to make more products. The extra investments would lead to higher economic growth.

Argument C

Tariffs expand the economy! When there were high tariffs in the late 1800s (1865-1890) there was also very high economic growth.

Argument D

Higher tariffs bring more money into the government, so it can perform more services for the American people.

Argument E

Tariffs make foreign companies pay a tax to sell goods in our country, which we can then use to enrich our country. They pay the tax and we get rich!

Arguments against a high tariff:

Argument F

American companies and American consumers end up paying the tariff tax in the form of higher prices. Those higher prices mean that people can buy fewer goods overall, which leads to lower economic growth.

Argument G

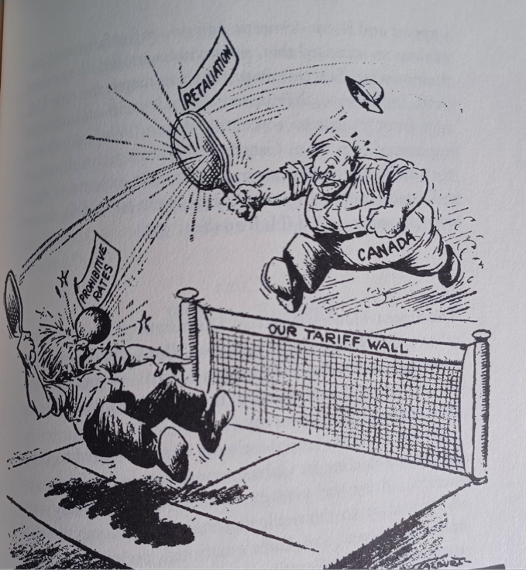

If we put a tariff on imports from other countries, those countries will then put a tariff on our exports to their countries. Imports and exports both go down. But keep in mind that we are better at making the goods we export (otherwise, we wouldn’t be able to export them) than the goods we import (otherwise, we wouldn’t need to import them). Thus, with lower imports and exports, we end up with fewer goods overall.

Argument H

Economic growth in the U.S. in the late 1800s was due primarily to population growth (more children, lower death rates, and more immigrants), not due to the high tariffs.

Argument I

Higher tariffs protect big business from competition, so they make higher profits. “The tariff is the mother of the trusts (monopolies).” Meanwhile, poorer people pay higher prices for their goods.

Students then need to answer the following:

Will you support higher tariffs? _______________________

Explain your answer.

Handout 1: Possible Answers

Arguments for and against a high tariff

Suggested answers: Student decisions about the tariff will vary, with different arguments having more or less weight in their decisions.

Handout 2: Evidence (Excerpt)

(7 out of 17 pieces of evidence)

Does the following evidence support or weaken the argument for higher tariffs? For each piece of evidence, write S for supports or W for weakens.

- According to a study in 2000 by Douglas Irwin, an economics professor at Dartmouth, most of the investment in machinery and other capital equipment in the late 1800s was in areas not involved in international trade, so was not protected by the high tariffs. Much of the investment was in railroads.

- Irwin and Bradford DeLong argued that tariffs reduced investment in machinery, so slowed economic growth over what it would have been without the high tariff.

- When the U.S. enacted a tariff in 1816, the American textile industry expanded, protected from competition from British textiles.

- The U.S. Constitution prevents states from passing tariffs against other states. Without tariffs between states, each area could specialize: Pittsburg-steel, Green Bay-meat packing, Detroit-cars, etc. The result is increased production and increased prosperity.

- When Germany passed a high tariff in 1871, it increased food prices for workers and thereby reduced demand for other products.

- In 1887, President Grover Cleveland called the high tariff a, “vicious, inequitable, illogical source of unnecessary taxation.”

- Politician Patrick Buchanan argued in 1998, “Behind the tariff wall (after 1865), the United States had gone from an agrarian coastal republic to become the greatest industrial power the world has ever seen.”

Suggested answers:

- Weakens a high tariff. It shows that the high tariff did not lead to buying more machinery.

- Weakens a high tariff. There was less investment in machinery (capital equipment) because the price of foreign machinery was higher.

- Strengthens a high tariff, since the 1816 tariff helped the textile industry to expand.

- Weakens a high tariff. Eliminating tariffs between states brought greater economic growth through specialization, implying that free trade would bring more prosperity between countries.

- Weakens a high tariff. There were higher prices and slower economic growth in Germany due to the high tariff.

- Weakens a high tariff. Democrats argued that people don’t prosper when they are subject to high taxes.

- Strengthens a high tariff. The politician argues that the U.S. became an industrial power because of high tariffs.

Handout 3: Outcomes

Congress voted to raise the tariff rates in the Smoot-Hawley Tariff Act of 1930.

According to many economic historians the tariff probably made the U.S. economy a little worse, contributing to a worse depression. We don’t know what effect the Smoot-Hawley Tariff had on prices, since the contraction of the economy from the Great Depression was much more important in driving prices down. Some industries were helped by a protective tariff while other industries were hurt by it. Component parts of goods were more expensive (due to the tariff), which raised the price for those components and thus the price for the final product. Many exporting businesses were clearly hurt by the tariffs put on by other countries in response to the American tariff. As with tariffs in general, the high tariff and retaliation by other countries meant that Americans were making goods that they were not as good at making, which meant fewer good being made than would have been made if there was free trade. Fewer goods by definition equals a decline in GDP. Overall, the Smoot-Hawley Tariff of 1930 had a small, negative effect on the U.S. economy.

Check out the Decision-Making in United States workbook here!

Sources

Hochberg, Fred. Trade is Not a Four-Letter Word. New York: Avid Reader Press, 2020, Introduction.

Irwin, Douglas. “Higher Tariffs, Lower Revenues? Analyzing the fiscal Aspects of the ‘Great Tariff Debate of 1888’”. NBER Working Paper No. 6239, 1997.

Irwin, Douglas. Peddling Protectionism: Smoot-Hawley and the Great Depression. Princeton, NJ: Princeton University Press, 2011.

Magness, Phillip. “The Problem with the Tariff in American Economic History.” Sept, 2023, Cato Institute. https://www.cato.org/publications/problem-tariff-american-economic-history-1787-1934

Get a free trial of Active Classroom to try these decision-making in United States history lessons with your students!

SIGN UP

Kevin O’Reilly taught history for 39 years, all but four of those years at Hamilton-Wenham Regional High School in Massachusetts. He is the former NCSS Social Studies Teacher of the Year, along with several other awards, and is the author of 31 books on critical thinking and decision making in history. He has two sons and five grandchildren. You can see his free critical thinking and decision-making lessons at www.criticalthinkinginhistory.com.