We’ve all seen it – we teach students the mechanics of checking and savings accounts, but still they struggle with impulse buys and the influence of social media ads. This is what we call the “knowing-doing gap” in personal finance, and it’s a challenge I’ve dedicated this blog to bridging.

Traditional financial literacy often focuses on the “what:” what a budget is, what an investment does, what a credit score means, etc. While this is crucial information, this archaic approach often overlooks the powerful, often irrational, forces that drive human behavior. This is precisely where behavioral economics steps in, offering a revolutionary lens through which to view and teach personal finance. It’s an interdisciplinary approach, blending insights from psychology and economics, to help us understand why we make the choices we do. As an economics and personal finance educator, discovering this field felt like finding the missing piece of the puzzle. It helps us design strategies to “nudge” our students towards smarter money habits and avoid common pitfalls.

Let’s dive into five key behavioral biases that significantly impact our students’ financial journeys, and more importantly, how we can address them in our classrooms.

1. Present Bias: The Allure of Now

We’ve all felt it – the irresistible pull of immediate gratification. Present Bias is the tendency to prioritize instant rewards over larger, long-term benefits. For our students, this translates to impulse buying, partying rather than working, or even applying for scholarships. Counselors struggle to motivate students to apply for college and scholarships because many prioritize their current comfort over the long-term benefits, avoiding the effort of writing application essays despite the future rewards.

Classroom Strategy: To counter this, help students connect with their “future selves.” Have them write a “future self” letter, detailing their financial aspirations. Use visual timelines to graphically illustrate the power of small, consistent savings growing exponentially over time. Breaking down large, daunting goals into small, achievable weekly or monthly steps can also make the future feel less distant and more attainable.

2. FOMO: Keeping Up (and Spending) with the Joneses

“Fear of missing out” (FOMO) is a pervasive anxiety, especially among young people, driven by the constant highlight reels on social media. It’s the pressure to participate in every trend, attend every event, or own every new gadget, simply because others are. This often leads to overspending and buying things they don’t really need or value. While chaperoning a prom, I was astonished by how much students spent on designer gowns, shoes, and limousine rentals—especially knowing many of them had been taught the cost of attending college, yet still couldn’t resist the allure of one extravagant night.

Classroom Strategy: Engage students in a “social media analysis” activity, dissecting how ads and influencer posts trigger FOMO. Introduce “true cost” calculations, where students calculate the real financial impact of “keeping up” versus alternative uses of that money. Most importantly, foster discussions around “values-based spending,” encouraging students to identify what truly matters to them and align their spending with those personal values, rather than external pressures.

3. The Endowment Effect: Overvaluing What We Own

The “endowment effect” is a fascinating psychological bias where we tend to place a disproportionately higher value on items we already own compared to identical items we don’t. This can lead to a reluctance to sell old items, or holding onto non-performing investments for too long, even when it’s financially illogical. During mock investing, some students refused to sell declining stocks they chose because “It was my pick” and they believe it’s still more valuable than its current price suggests.

Classroom Strategy: A “sell it or keep it” exercise can be very insightful. Bring in various items (or use pictures) and have students debate their perceived value, first imagining they own it, then imagining they don’t. This opens the door to discussions on “opportunity cost” – what else could that money or asset be doing for them? Financial role-playing scenarios involving selling assets can also provide practical experience.

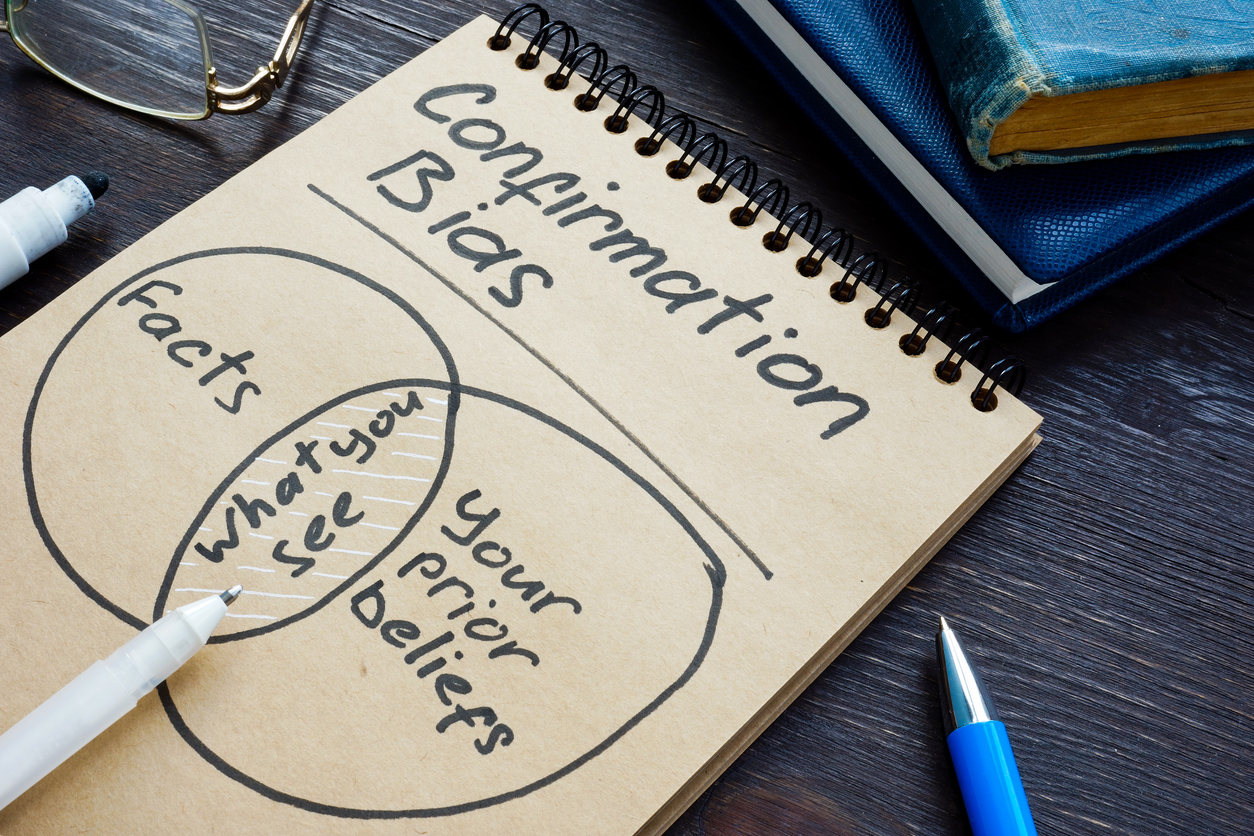

4. Confirmation Bias: Seeing What We Want to See

Confirmation bias is our natural inclination to seek out, interpret, and remember information that confirms our existing beliefs, while ignoring contradictory evidence. In finance, this can be dangerous. Students may seek out TikToks and social media content that validate their interest in risky cryptocurrency investments, while ignoring credible financial advice that urges caution. This bias can also lead them to fall for scams or “get rich quick” schemes simply because the message aligns with what they want to believe.

Classroom Strategy: Encourage “devil’s advocate” debates on financial topics, requiring students to research and argue both sides of an issue, even if it contradicts their initial stance. Teach critical evaluation by analyzing multiple financial news sources and advice columns. Present common financial myths and lead “fact-checking scenarios” to help students uncover the truth independently.

5. Dark Patterns: Hidden Tricks in Online Choices

In our increasingly digital world, “dark patterns” are user interface designs subtly crafted to trick users into doing things they might not intend, such as signing up for unwanted subscriptions, making accidental purchases, or sharing excessive data. These are often hidden fees, pre-checked boxes, or confusing cancellation processes. I’m constantly amazed at how pervasive these are, and how easily even adults can be misled. I’m sure I’m not the only one with a subscription I meant to cancel but forgot all about it.

Classroom Strategy: Conduct a “Spot the Dark Pattern” activity using screenshots from real websites or apps. Have students identify deceptive buttons, confusing opt-outs, or hidden charges. A “Terms & Conditions Deep Dive” can teach them to scrutinize fine print. Most importantly, empower them with consumer advocacy skills, discussing how to identify and report deceptive practices.

Bringing Behavioral Economics to Life in Your School

Integrating behavioral economics isn’t just about adding a new lesson plan; it’s about shifting our approach to financial education. Beyond the classroom, consider school-wide initiatives like “Financial Wellness Fairs” with local financial institutions, or student-led “Financial Hacks” campaigns sharing tips to counter these biases. My vision is to see every school cultivate a truly financially savvy community, where parents and students alike are empowered.

The journey to empowering financial decision-makers is continuous, but by understanding the psychological underpinnings of our choices, we can equip our students with far more than just facts. We can give them the awareness and strategies to navigate the complex financial world with confidence and wisdom. Start small – pick just one bias or strategy to introduce next school year. Observe, adapt, and share your successes with other educators. Together, we can make a profound difference in our students’ financial futures.

Want more lessons and activities for your Economics classroom?

Get a free trial of Active Classroom to explore more instructional resources.

Vincent Branch is an educator and school administrator based in Houston, Texas, with over a decade of experience teaching U.S. History and Personal Financial Literacy. A former financial services professional, he now advocates for making financial education a graduation requirement nationwide. His goal is to support teachers in empowering students with the knowledge and decision-making skills they need to thrive in both civic life and personal finance.